FINRA’s Series 7 Examination is also referred to as the Series 7 Top-Off Exam. This is because, when you seek to earn your Series 7 License, you will first take the SIE Exam and then “top off” the SIE with the Series 7 (or Series 6).

This makes sense as both the SIE and Series 7 Top-Off Exam cover a lot of the same general material, and they are both corequisites for the Series 7 License (also known as the General Securities Representative registration). This license authorizes the holder to act as a general securities representative in selling securities to customers.

A few of the products that someone with a Series 7 license can sell include: bonds (corporate, treasury, municipal), stocks (common, preferred, rights, warrants), partnership units (DPPs), investment company units (UITs, ETFs, mutual funds), hedge funds, money market funds, options, REITs, and a myriad of other products.

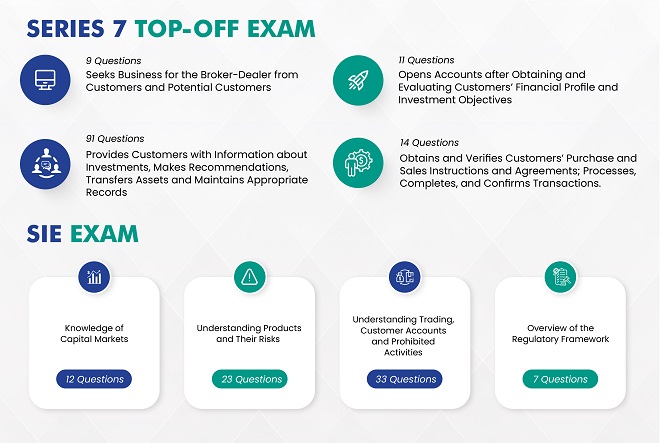

In terms of the content on both the SIE and the S7 Top-Off, the table below breaks down both content outlines:

As you can see, both content outlines focus heavily on the types of products that exist and their respective suitability for different types of customers. The Series 7 Exam will go much more in depth on suitability than the SIE goes.

After the 7, most representatives will register for and take the Series 66 Exam (also known as the Uniform Combined State Law Examination). This is a North American Securities Administrators Association (NASAA) exam that is offered and conducted through FINRA.

The SIE + S7 + S66 combination registers representatives as both agents of broker-dealers and investment advisor representatives under an investment advisor company.

Another common combination is the SIE + S6 + S63/S65, which is more common for professionals in the insurance industry though it is not exclusive to that sector.

If the representative wants to become a manager, they may find themselves taking the Series 9/10 or Series 24, which are principal exams.