Series 7 Licensing Overview

If you’re looking at a career in financial services, then you may have heard about the FINRA Series 7 License.

The Series 7 Exam, also known as the General Securities Representative Qualification Examination, is a test created and administered by the Financial Industry Regulatory Authority (FINRA), the self-regulatory organization for securities professionals. FINRA Series 7 licensing is a big step in your financial services career and we are here to provide you with all of the information you need to pass the test and get your license.

In this article, we will cover everything there is to know about the FINRA Series 7 exam and answer any questions you may have.

What does Series 7 Licensing allow you to do?

The Series 7 qualifies the holder to sell many different types of securities as representatives of a broker-dealer, including but not limited to:

- Public offerings and/or private placements of corporate securities (stocks and bonds)

- Rights and warrants

- Mutual funds, money market funds, unit investment trusts (UITs), and exchange-traded funds (ETFs)

- Real estate investment trusts (REITs)

- Options on mortgage-backed securities

- Government securities, repos, and certificates of accrual

- Direct participation programs (DPPs)

- Municipal securities

- Hedge funds/venture capital funds

With a Series 7, you can sell almost any investment product.

Who can take the Series 7?

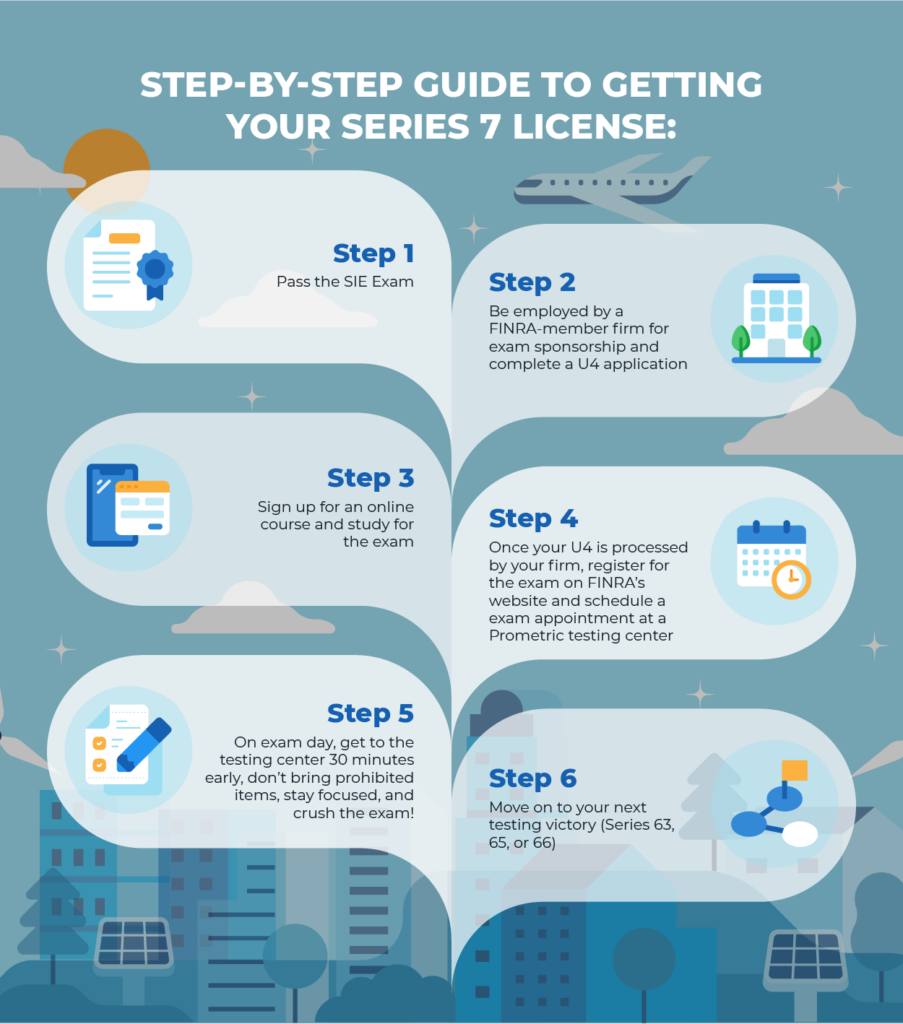

Although the FINRA Series 7 Exam has been around since the 1970s, in 2018, FINRA split the Series 7 exam in half and created an entirely new test called the Securities Industry Essentials (SIE) exam. The SIE covers a lot of the same things that were covered on the old Series 7. After this change, the Series 7 was shortened both in terms of questions on the exam and the testable content those questions are drawn from.

The SIE’s content outline covers capital markets, investment products, regulations, customer accounts, trading, and prohibited activities. The SIE is considered an easier exam than the Series 7 due to its shorter nature. Studying hard for the SIE will make Series 7 licensing even easier, since there is some overlap in content that is covered on both tests.

Whereas the SIE exam can be taken by anyone regardless of whether they are affiliated with a FINRA-member firm or not (which makes it great for students), you can only register and sit for the Series 7 exam if you are sponsored by a FINRA-member firm. This means you need to be employed with a company who will sponsor you to take the exam; you cannot take the exam without being sponsored.

In addition, the SIE is considered a “corequisite” for the Series 7, which means that both are required but you can take them in any order. Usually, the SIE is taken before the Series 7. While you could take the Series 7 exam without already have credit for the SIE, 99% of the time, you will take the SIE first and the Series 7 “top-off” after. This is because the SIE is easier and covers a lot of foundational knowledge.

What is the structure of the Series 7?

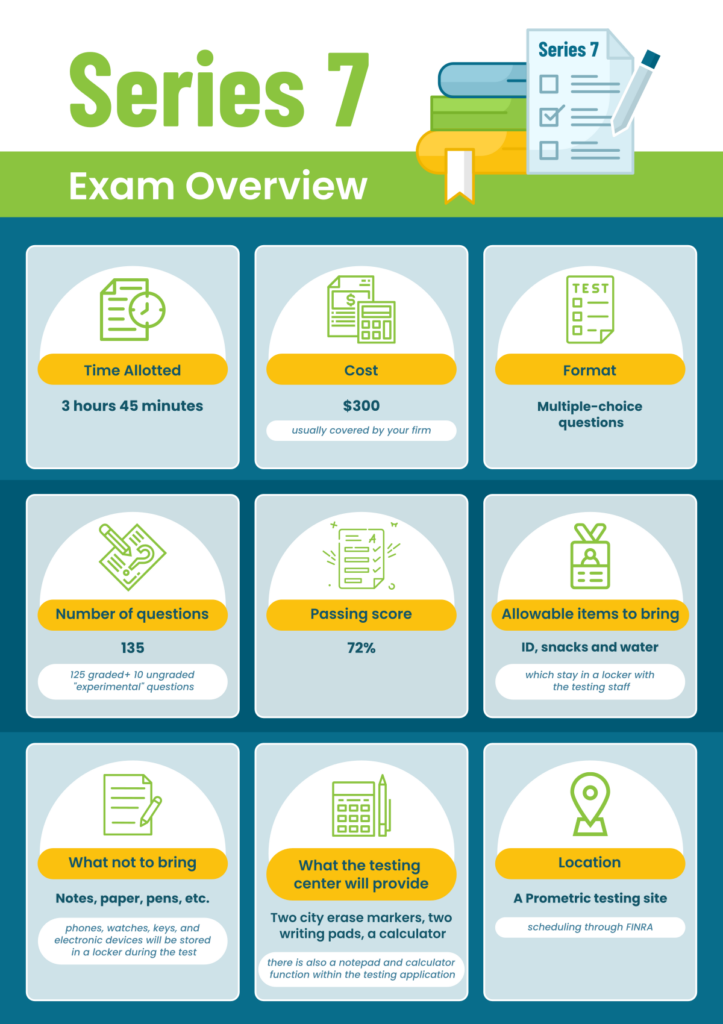

The Series 7 exam consists of 135 questions, of which 125 are scored and 10 are un-scored developmental questions that FINRA randomly cycles through to test against the existing question bank (you will not know which questions are un-scored, so make sure you answer each question to the best of your ability).

You have 3 hours and 45 minutes to take the exam, which gives you plenty of time to work out each problem (most questions do not require detailed calculations).

The format of the exam is multiple-choice, just like the SIE. Although you may see k-type questions in your test prep material, there are no k-type questions on the actual exam. (K-type questions are also known as complex multiple choice questions. They include a list of statements numbered with roman numerals, and you must choose which of these statements are true.)

The passing score on the exam is 72%. Although official numbers for the pass rate of the exam are not public, it is generally assumed that around 65–70% of those who take the exam pass.

The cost to take the Series 7 is $300, which will normally be paid for by the firm that sponsors you.

What content is on the Series 7?

FINRA makes a content outline available to everyone online, which lists the laws and rules from which the exam questions will be pulled from. It is an application-driven exam, meaning there will be many questions where you must apply a piece of information or knowledge to an example. This is why you must have a firm understanding of the regulations in order to apply them to different scenarios.

In the content outline itself, the exam is broken down into four sections:

- Seeks Business for the Broker-Dealer from Customers and Potential Customers (9 Questions, 7%)

- Opens Accounts after Obtaining and Evaluating Customers’ Financial Profile and Investment Objectives (11 Questions, 9%)

- Provides Customers with Information about Investments, Makes Recommendations, Transfers Assets and Maintains Appropriate Records (91 Questions, 73%)

- Obtains and Verifies Customers’ Purchase and Sales Instructions and Agreements; Processes, Completes, and Confirms Transactions (14 Questions, 11%)

As you can see, Section 3 makes up 73% of the exam, as it focuses on the different investments and procedures around selling securities to customers. Some of the key content areas you will see questions on are suitability, stock options, taxes, debt, equity, and customer accounts, among others.

How should you study for the Series 7?

It is generally recommended that you spend 100–150 hours studying for the exam over a 4–6 week period. We highly recommend that you sign up for an online course. Many times, your firm will use a specific vendor and will pay for you to study full-time for a month or two. If you don’t know where to start, you can check out our reviews of the best Series 7 courses.

For the Series 7 (and most FINRA exams for that matter), you should make it a priority to test yourself on the content regularly. Rereading books or watching videos, while helpful, are not as important as completing practice questions and practice finals. When it comes to studying, quizzing yourself takes advantage of the active recall function, which helps us to memorize new information as we withdraw it for use. Doing this over several weeks (spaced repetition) will give you the biggest return on your time.

What to know when registering for the Series 7

Once your U4 is completed by your firm, they will normally send you the information needed to register for the exam. You will register on the FINRA website using your CRD number (which will be different than the “T” number you may use when taking the SIE). You will schedule the exam at a Prometric testing site and will receive all the necessary details via email.

What to know when taking the Series 7

It is important to get plenty of sleep the night before exam rather than trying to cram. It is recommended that you go through your normal routine rather than trying to do something different the morning of your exam. Many people take the test in the morning or afternoon.

When you show up to the testing center, you will go through the same procedures you likely would for the SIE: check your ID, put your items in a locker, and sign in to the testing center. You will be provided a calculator and scratch paper that you can use during the exam.

Once you are taking the exam itself, remember to take it slow and do your best!

What happens after the exam?

Of course, we are hoping that you pass your exam with flying colors the first time around. If, however, you miss the mark, you will have to wait 30 days before retaking the exam. If the second attempt also results in a fail, there is another 30 day waiting period. For the third attempt and each attempt thereafter, there is a mandatory 6 month waiting period (and for each retest the exam fee has to be paid again). But if you study smart, you should pass the first time around!

Once you pass the exam and complete your Series 7 licensing, most will go on to take the Series 63, 65, or 66. These are North American Securities Administrators Association (NASAA) exams that cover state securities laws. They are needed in order to be registered as an Investment Advisor Representative. Most professionals who require licensing for their job either get a Series 6 + 63/65 or a Series 7 + 66.

Summary

There you have it! All of the essential information about the Series 7 exam and how to complete the Series 7 licensing process; easily one of the most important FINRA exams out there. Although the test is certainly difficult, once you complete it you will be one step closer to filling your role in the financial services industry. Remember to study smart and to study hard and that testing victory will be yours!